I am constantly researching my competition. If I’m standing outside a restaurant, waiting for a table, and there’s an apartment building across the street with a “for rent” sign, I will call that number.

I want to know.

How much for a 1-bedroom? How much for two? How many square feet? Are they offering move-in specials, and if so, what are the specifics?

“Quick curiosity,” a buddy of mine calls it, and the information you gain in the steady accumulation of those moments is invaluable.

You can drive through a neighborhood and admire the shiny new buildings, but behind that glass and brick may be below-market rent rolls and a high vacancy rate. Some of this may have to do with poor management and marketing, but you also want to know how these new builds (and old) are fairing in the current market. Did development get ahead of demand? If you build in that dreamland, will the rents be competitive? And then, of course, the more data you have, the more opportunities you have to spot gaps in the market. Sometimes, people spend so much time playing follow-the-leader that they buzz by opportunities that could be revealed by practicing quick curiosity and, of course, doing due diligence.

In last week’s Development 101 post on evaluating your target market, I revealed the three questions I ask when doing preliminary research on a neighborhood.

Is it growing?

Do people have good jobs with growing incomes?

Are housing prices rising?

If the answer is yes to all three of these questions, I start looking at competitors.

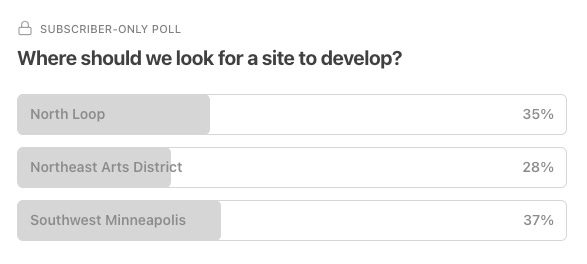

Last week, I offered up three potential neighborhoods as possible places to develop, and you voted on your preference:

The North Loop (young, hip, the old warehouse district in Minneapolis)

The Northeast Arts District (old-school bars, lots of artist studios, and older single-family housing)

Southwest Minneapolis (near the chain of lakes, primarily residential, mostly tranquil with vibrant pockets of commercial activity mixed in)

At the time I sat down to write this post, here were your votes:

Very, very interesting! There’s a clear preference for the North Loop and Southwest Minneapolis. From the emails and comments posted, I'm going to guess that you’re attracted to the above-average incomes in both neighborhoods and the consistently rising home prices (North Loop!)

But what about the competition? How do we assess it?

The first thing we need is to have some idea of the size of our build. Is this our final number? No. But we need to figure out whether we’re building five units or fifty. In this economy, given the high-interest rates and the cost of construction, let’s aim for something modest YET contains, within it, economies of scale. So, for now, let’s run our competitor analysis for each dreamland using buildings at least 50 units or greater. And we want to look at newer construction, preferably projects built within the past three years.

Why?

Because that is your new project’s competition, not an older apartment building built in 1973 with no amenities or in-unit washers and dryers!

As a side note: Did I spend my afternoon identifying competitors in each of the various zip codes and then dialing for data? No, no, I did not. I’m a big fan of working smart, not hard. I had someone hop on apartments.com and pull together a data set, and then I asked a bunch of questions (You, too, can do this. It is not as complicated as it sounds!).

So here’s what our competitor analysis reveals after removing “outliers” (meaning amongst similar buildings, we removed that one crazy penthouse that rents out for $10k a month and is currently sitting vacant :-)

Northeast Arts District:

Average Rent: $1,903

Median Rent: $1,730

Minimum Rent: $1,344

Maximum Rent: $2,996

Average Unit Size: 675 sq ft

North Loop:

Average Rent: $2,199

Median Rent: $2,059

Minimum Rent: $1,486

Maximum Rent: $3,810

Average Unit Size: 860 sq ft

Southwest Minneapolis:

Average Rent: $1,725

Median Rent: $1,452

Minimum Rent: $1,095

Maximum Rent: $3,555

Average Unit Size: 750 sq ft

Okay. So…

From this data, the North Loop has both the highest average rent and the largest average unit size. On the other hand, Northeast has the smallest average unit size, though its average rent is the second highest among the neighborhoods.

In terms of rent per sq ft:

Northeast achieves the most with an average of $2.82 per sq ft.

North Loop is next, averaging $2.56 per sq ft.

South Minneapolis achieves the least per square foot, averaging $2.30 per sq ft.

In terms of what each unit type achieves by average rent per square foot:

Studio: $2.81 per sq ft

3 bedroom: $2.65 per sq ft

1 bedroom: $2.55 per sq ft

2 bedroom: $2.34 per sq ft

Studios have the highest average rent per square foot, while 2-bedroom units have the lowest among the listed unit types. Interestingly enough, while studios achieve the highest average rent, they are only found in 53% of the buildings in the data. (opportunity, perhaps?)

Whew!

Now…

Given what you know about growth, income, housing prices, and average rents, where would you look to build?

Since we last voted, did you change your mind? See anything intriguing in the data we should pursue? Curious about anything?

Take another vote, and then we’ll roll up all this information into a decision!

Looking for a community in your area? Cohorts is a small, vetted, private group of real estate operators that meet regularly, build relationships, and share resources to grow their real estate businesses together.

I commented on the other post, and now wondering if I'm still on track with SW.

Again, haven't looked at zoning, so maybe this just isn't allowed.

But my thought was again that there probably isn't enough supply of higher-end apartments in SW - apartments that are attainable to people who want to live in the nicer neighborhood, but where those same persons can't afford the very high home values of SW.

Given how low the average rents in that neighborhood are from your analysis, I'm not sure whether this helps validate my thesis from the last post (i.e. all the apartments that are there are very old, driving down rents) or if it invalidates my thesis (there are numerous higher-end apartments, but it seems people aren't willing to fork over what it takes to buy them, so it's a bad spot to build).

In fact, given the high rents of Northeast, I find myself wondering if it's already "peaking" - a lot of supply is about to come online there, and will be online before a new 50-unit could be built, breaking pro-forma estimations of rents and rent growth.

On the other hand, NE has lower land values, making it easier to build in to begin with, and also easier to demonstrate value to a bank financer (e.g. rents are high, land cost is low). for the SW bet to pay off, you'd have to convince a bank that although rents are currently low and land cost is high, YOUR building will be different - and that seems like a real uphill battle.

Static data is one component but isn't momentum just as important a factor? I would want to look at longer term trends, (like other mixed-use developments in the approval pipeline, federal or state grants for infrastructure, etc?) I'm assuming you'll get to this but in my city, Rochester NY, theres a 10 year plan to spend a couple hundred million dollars (state and fed $) to fill in an old highway that bisected some great neighborhoods and I've got a keen eye on how that level of government investment will hopefully be the tide that rises in that area. I'm also a sucker for rehabbing old industrial buildings into apartments so if you're gonna help improve the value of those neighborhoods my vote is North Loop!